In the last few months, EU governments (Denmark and Germany foremost among them) have made major moves to exit the Microsoft ecosystem, opting instead for open-source alternatives. In response to this, and the intensifying global debates over data privacy, national security, and digital autonomy, Microsoft has unveiled its Sovereign Cloud initiative.

According to Microsoft CEO Satya Nadella, “Microsoft is committed to a model of digital sovereignty that empowers individuals and institutions to work independently, securely, and autonomously.” This suite of cloud environments is designed to deliver public-sector-grade data controls, enforceable legal jurisdiction, and enhanced access governance—addressing growing demands from governments and large enterprises alike.

Some expert analysts believe that this change is just a repackaging of Microsoft products, giving customers the illusion of control whilst Microsoft retains ownership of the “code base, update cycles, and key mechanisms — even if the server location changes.”

In this article, we’re taking an in-depth look at what the Sovereign Cloud is, and what governments and organizations need to understand about this pivotal launch.

On June 16, 2025, Microsoft detailed a three-tiered strategy within its European ecosystem.

This model enforces that all data must be stored and processed exclusively within EU borders under EU law. Only EU-resident personnel are permitted to authorize remote access, and all such events are recorded in tamper-evident logs. Customers can bring and manage their own encryption keys via hardware security modules (HSMs). A centralized management portal allows organizations to audit access controls and policy configurations comprehensively.

This tier is suited for highly regulated scenarios requiring on-premises or fully air-gapped deployments. It includes localized versions of Microsoft 365 and Azure, where governance remains entirely with the customer or their designated partner.

In this model, cloud services are operated by local European entities under partnership with Microsoft. For example, in France, the “Bleu” cloud is operated by Orange and Capgemini to meet SecNumCloud compliance. In Germany, “Delos Cloud” is managed by SAP to fulfill German federal mandates.

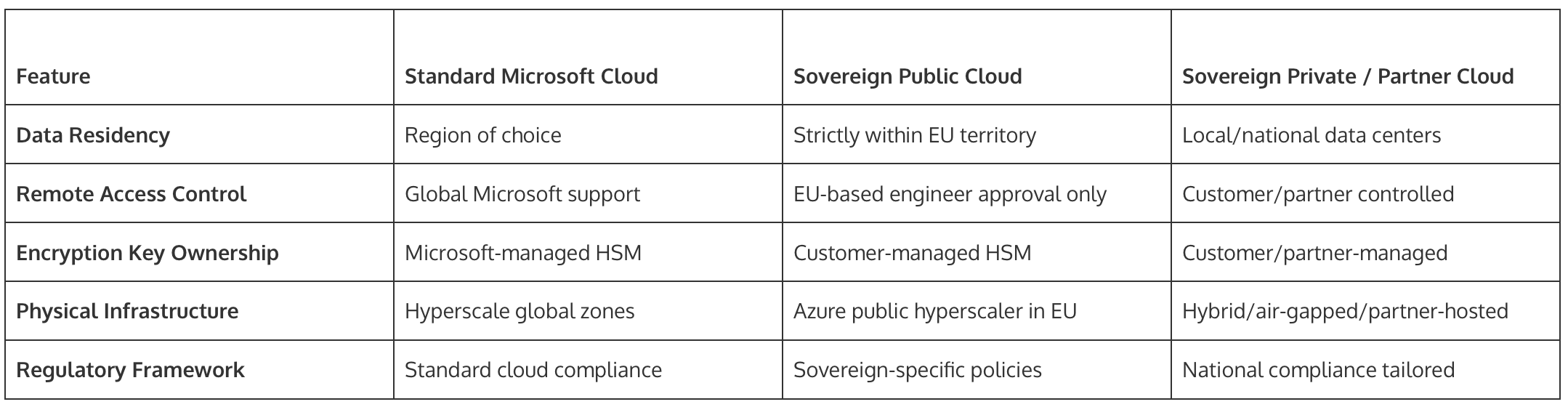

A detailed comparison of Microsoft’s standard and sovereign cloud offerings highlights differences in data residency, remote access control, encryption management, infrastructure, and regulatory compliance. Each tier increases the degree of sovereignty, control, and localization.

Digital sovereignty has become essential in cloud procurement for governments. Sovereign Cloud ensures that data remains within the EU and can only be accessed by locally authorized personnel. Encryption key management remains under customer control, reducing risks of foreign legal intrusion. A comprehensive audit trail provides visibility and supports policy enforcement.

Microsoft has committed to challenging extraterritorial data requests from non-EU jurisdictions. However, there remains residual legal risk under laws such as the U.S. CLOUD Act. Despite Microsoft’s proactive legal stance, organizations cannot assume complete immunity.

Despite the progress, core infrastructure still remains under Microsoft’s control, which may not satisfy the strictest sovereignty requirements. Legal vulnerabilities, such as compliance with U.S. subpoenas, still exist. Additionally, some service gaps may arise as sovereign cloud offerings work toward feature parity with global Azure regions.

Highly regulated industries such as financial services, healthcare, and defense will benefit from enhanced control. Multinational SMEs navigating GDPR and other regional regulations may find Sovereign Cloud a practical solution. Organizations deploying AI models or managing high-value intellectual property will find reassurance in enhanced encryption and residency controls.

The use of national partner clouds allows companies to collaborate with locally based experts, reducing dependency on centralized support models. Microsoft’s Sovereign Landing Zones and infrastructure templates lower implementation complexity and cost. Hybrid IT integration becomes easier as customers can align on-premises architecture with national cloud instances.

The sovereign cloud market is expected to grow from $123 billion in 2024 to $155 billion in 2025, eventually reaching $824 billion by 2032, reflecting a CAGR of approximately 27 percent. Both U.S. and European providers are actively investing in capabilities to meet the growing demand.

Hyperscalers like Microsoft, AWS, Oracle, and Google are shifting toward localized sovereign models to meet regional compliance expectations. European governments have voiced increasing concern about dependency on U.S.-based providers, particularly given the implications of the CLOUD Act.

National cloud providers, such as Exoscale and Elastx, are emerging as viable alternatives. Microsoft’s partnerships with SAP and Capgemini signal that local operators are central to delivering sovereign infrastructure.

Organizations should conduct a full audit of their data based on sensitivity and regulatory exposure. Classifying data by risk category enables alignment with the appropriate tier of Microsoft’s Sovereign Cloud.

Companies should consider Sovereign Public Cloud for EU-wide regulatory compliance, and Sovereign Private or Partner Clouds for workloads that demand national-level control or air-gapped environments.

It is crucial to validate Microsoft’s Data Guardian protocols during initial deployments. Using Terraform-based Sovereign Landing Zones simplifies policy enforcement and infrastructure governance.

Enterprises should deploy customer-controlled HSMs from the start and establish robust encryption key policies for rotation, revocation, and audit.

Procurement teams must negotiate terms that explicitly define how extraterritorial data requests will be handled. Contractual protections should also cover partner-operated environments.

It is important to continuously monitor Microsoft’s roadmap to align operations with upcoming capabilities. Where feature gaps exist, companies should build transitional strategies using private infrastructure or open-source stacks.

What This Signals for the Market

Shift in Global Cloud Dynamics: Cloud strategy is evolving from global uniformity toward localized, sovereignty-aware solutions. Microsoft is leading the charge with a structured, multi-tier approach.

Emergence of a Fragmented Cloud Ecosystem: We are entering a multicloud world where organizations may operate across standard Azure, Sovereign Public, Sovereign Private, and partner clouds simultaneously. This fragmentation will require stronger cloud governance frameworks.

Regulatory Alignment & Standards: A coherent regulatory framework is needed to standardize what qualifies as sovereign cloud under GDPR and national regulations. Analysts suggest the development of a Sovereign Cloud Code of Conduct.

Competitive Landscape for Enterprises: With the availability of national cloud instances, enterprises gain negotiation leverage. Vendors and managed service providers will need to adapt their delivery models to accommodate sovereign infrastructure.

Real-World Case Studies

UAE “Core42 – Microsoft” Collaboration: The Core42 deployment in the UAE exemplifies how sovereign cloud can support 11 million daily digital transactions. Global spending on sovereign cloud is expected to double from $133 billion in 2024 to $259 billion by 2027.

Public Sector Pilots: France’s Bleu and Germany’s Delos Cloud provide working examples of how Microsoft and its partners are operationalizing sovereignty at scale. These deployments are tailored to local mandates and audit frameworks.

Microsoft’s Sovereign Cloud is a significant advancement that helps governments and enterprises achieve a balance between modernization and compliance. It provides essential tools for enforcing data residency, controlling encryption, and limiting jurisdictional exposure.

However, true sovereignty remains a layered objective. Legal risks under U.S. law, infrastructure ownership, and service gaps mean organizations must remain vigilant. A combination of Microsoft Sovereign Cloud and complementary strategies—like hybrid deployments and legal safeguards—is required to achieve digital self-determination.

Microsoft’s Sovereign Cloud represents an inflection point in the evolution of cloud strategy. For CIOs, CISOs, and procurement leaders, it offers a practical path toward achieving regulatory compliance and digital autonomy without sacrificing functionality or scale. Yet, it should be viewed not as a complete solution but as a vital component of a broader, multilayered sovereignty strategy